Recurring Card Payments

This guide explains how to implement recurring card payments. This type of payments allow to tokenize a card and later charge it based on agreed terms without customer participation.

All process consists of two main steps:

- Step 1: Card tokenization

- Step 2: Charging received token

Step 1: Card tokenization

During card tokenization step customer enters card data and gives a consent to charge it later based on agreed terms. If you would like just to tokenize a card without a payment, then it is possible to use 0.00 EUR amount. You could also tokenize a card with any other amount if your business logic requires that - for example paying for first month subscription and giving a consent to charge monthly.

Card tokenization is possible only by using our Iframe js for Card Payments. Follow that guide, and pay attention to such details:

- When using

POST Create Transactionendpoint pass"recurring_required": true. - When loading

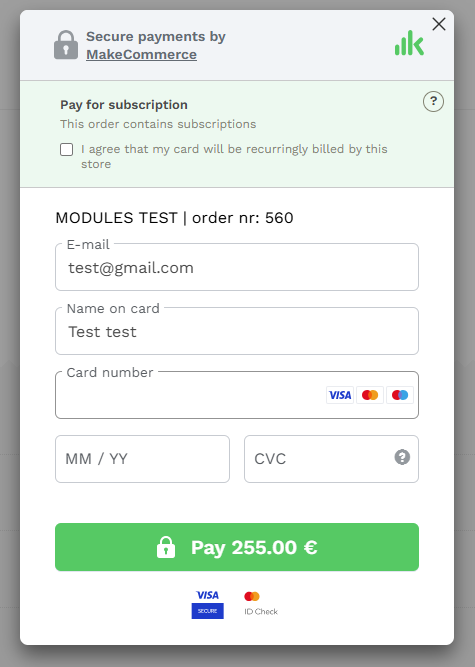

chekout.min.jsuserecurringTitle,recurringDescriptionandrecurringConfirmationoptions where you should clearly describe the terms customer should agree upon to be charged in the future. Usage of these options will result in the following view:

After transaction is COMPLETED make sure you are storing token id returned in token_return message. This token id will be needed to make recurring payment.

Step 2: Charging received token

When you have a token, you could charge it without customer participation by following such process:

- Use

POST Create Transactionendpoint to create a transaction and receive it’s id - Use

POST Create Paymentendpoint with received transaction id in the path and token id in the body - Handle transaction status, if payment succeeded:

- a. Response of

POST Create Paymentwill containtransactionobject andstatusparameter inside it. Follow documentation of Transaction statuses. - b. Your system will receive asynchronous

payment_returnmessage tonotifications_urlas explained here.

- a. Response of

- Handle transaction status, if payment failed:

- a. Response of

POST Create Paymentwill have 400 HTTP status and body with structure which provided bellow. For all codes check Possible error codes for POST Create Payment..

{

"code": 1034,

"message": "Insufficient funds"

}- b. Your system will receive asynchronous

payment_returnmessage tonotifications_urlas explained here.

- a. Response of

Keep in mind that each token has it’s valid_until parameter which is returned during Step 1 with token_return message. After that date it won’t be possible to charge that token and you will need to invite customer to tokenize a new card.

To avoid fraud, our system has a logic to make token inactive after a certain amount of failed charge attempts or after specific fraud related declines.

Possible error codes for POST Create Payment

| Code | Message |

|---|---|

| 1011 | Shop not active |

| 1012 | Card payments not enabled for this shop |

| 1013 | Recurring disabled for shop |

| 1021 | Transaction in wrong status |

| 1031 | Payment in wrong status |

| 1032 | Cannot make payment (transaction status violation) |

| 1033 | Card expired |

| 1034 | Not sufficient funds |

| 1035 | Payment declined |

| 1036 | Authorization failed |

| 1061 | Invalid transaction |

| 1062 | Transaction conflict |

| 1064 | Token expired |

| 1065 | Token in wrong status |